The August 1st Bidding Exercise had both Category A and Category B COE Quota Premium heading north. The effect of the stock market drop didn't hit earlier and the three weeks order cycle had bring in highest sales numbers. Here is my prediction for the August 2nd Bidding Exercise:

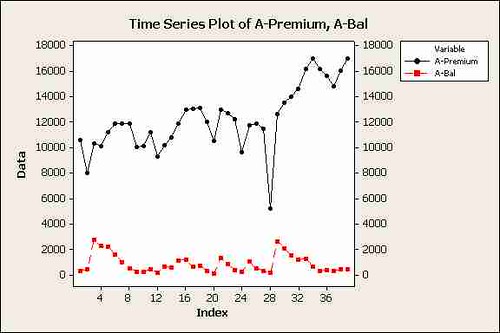

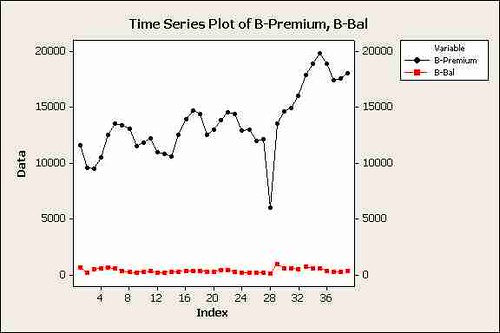

Let's look at the time-series plots below, you can see that the balance (ie. unsuccessful bidders) for the past four bidding exercises have stayed quite constant between 300 to 500 for the category A and between 200 to 350 for the category B. This is an indication that the demand has only exceeded the supply by between 20% to 30% and thus, most of the distributors would still be able to fulfill their orders as most have the sales agreement with three to four bids.

You can see that there is always an increase in bids in the exercise following a plunge in the quota premium since most distributors had dropped their selling price. However, the down side is that the distributors may not be successfully to secure the COE if the upswing in the next few bidding exercises is too steep.

I predict that the COE Quota Premium will fall marginally in the August 2nd bidding exercises for these reasons:

1. Some distributors have already revised the car price up by $1,000

2. Closing date on August 22 offers only a two-week cycle

3. Uncertainty of the stock market over the effect of the US sub-prime concern

Prediction on August 12:

Category A: $16,000-17,000

Category B: $16,000-17,000

Verdict on August 22:

Category A: $ 8,118

Category B: $16,010

Remarks (Aug 22): One more factor to be considered is that it is the Hungry Ghost month.

No comments:

Post a Comment